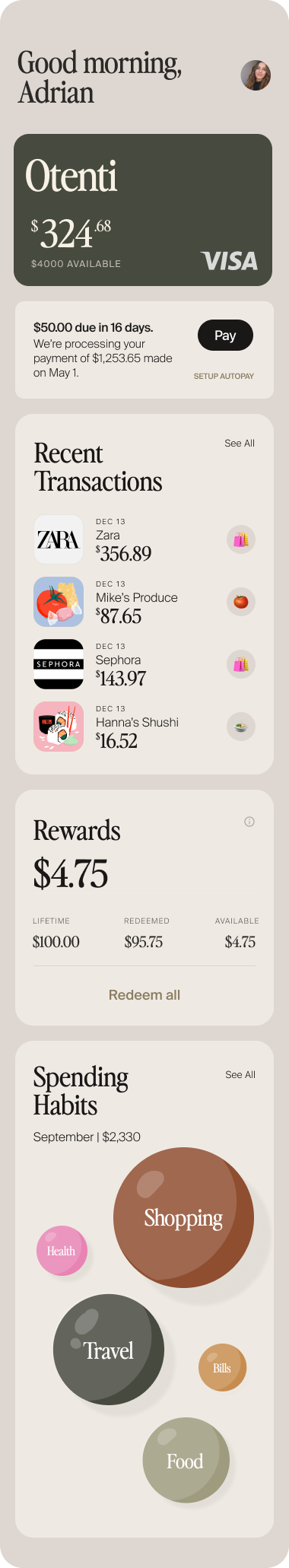

A mobile-first credit card platform

Reduce the cost and complexity of building your own credit card program

Launch your own world class, scalable, and secure card program

Stand out with a beautiful, user friendly, mobile experience

Increase customer loyalty with an expanded offering

Drive frequency and brand relevance with unique rewards

We’re here to unlock speed and innovation in the credit card space

Existing credit card systems are old, rigid and expensive

Our innovative core processor is now the future of credit cards

A re-imagined credit card stack

Built with a mobile-first approach, our entire credit card stack is vertically integrated

Innovation

Ability to innovate quickly without inter-company constraints

Speed

Faster feature development and updates across mobile and core processing

Control

Full control over data guarantees error-free reconciliation

Processor

Real-time, digital-first, cloud-native processor that was built to take advantage of mobile capabilities in real-time, making it more secure, smooth, and feature-rich.

Mobile App/SDK

Get a branded, native mobile app, or integrate into your own app.

Servicing

A full package of everything you need to run a credit card program, including: disputes, payment processing, credit bureau reporting, credit line increase/decrease, rewards, statements, etc.

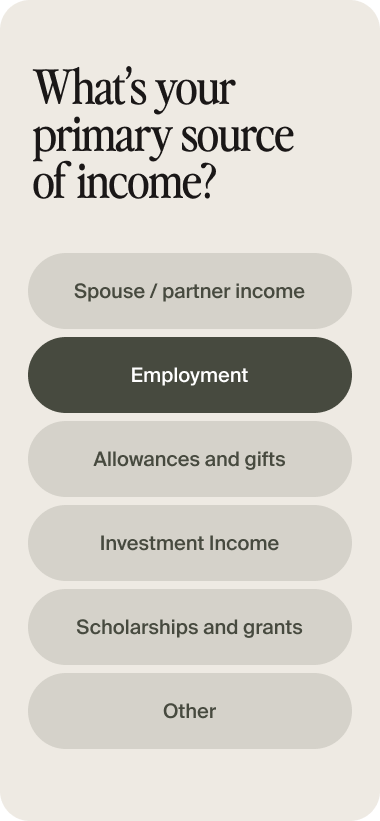

Origination

Underwrite by utilizing credit bureau, cash flow, and incorporating your own proprietary data for optimal credit performance. Implement KYC, KYB, and fraud controls for both consumer and commercial applications to ensure security and compliance.

Core Processor Innovation for credit

Deserve’s processor technology has unlocked innovation and possibilities for banks, fintechs, and brands

Real-Time

Watch the data update before your eyes

Hierarchical Ledger

Flexibility to innovate in loan product space

Cloud-Native

Scale to millions of users without issues

Digital-First

Instant card issuance and unlimited virtual cards

Mobile-firstA game changer

Instant card issuance, reduction in fraud and a beautiful experience

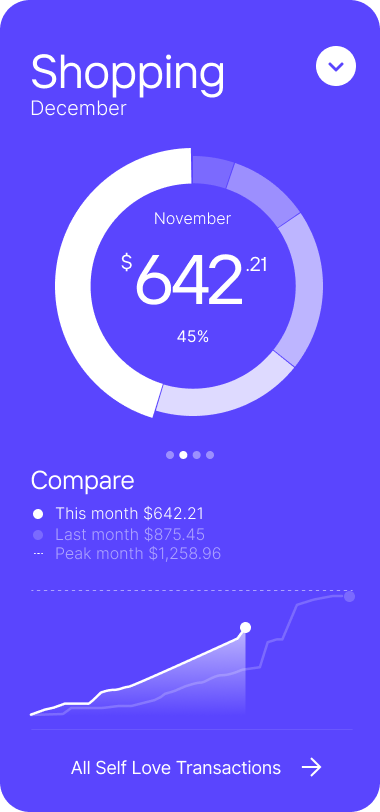

Deliver the best experience and reach your financial goals

User centric design and brand aesthetic, leading to top of wallet

Easy, reliable and strong identity verification with significant fraud reduction

Instant issuance to 100% of approved customers, leading to higher activation

Create unlimited virtual cards within your wallet and set controls.

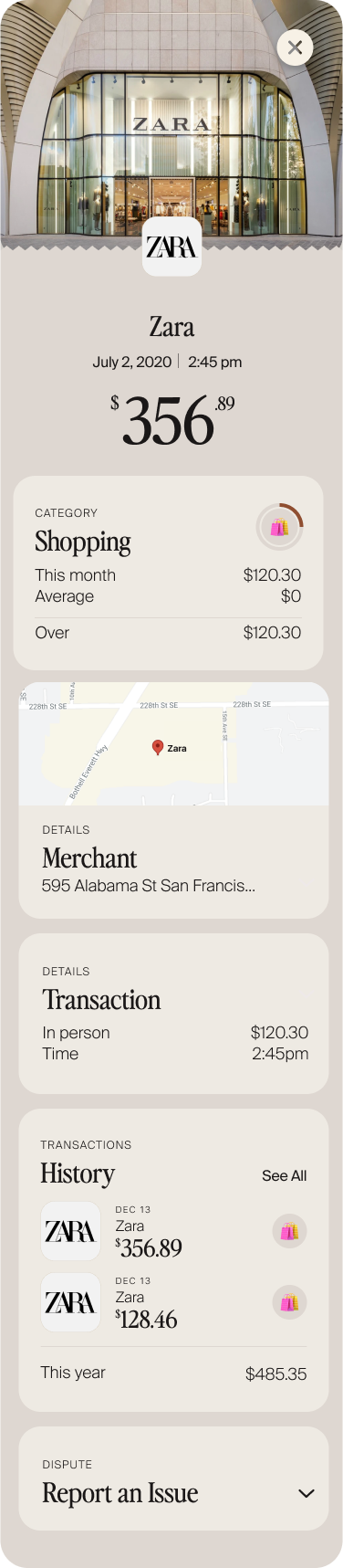

We provide clean merchant names with a logo, photo, and map. Transaction details are displayed in an organized, easy to understand view.

Set monthly limits, monitor spending and get clear transparency on who made what transaction.

Get notified when an unknown device is trying to add your card to a digital wallet so you can approve or decline it.

Block merchants and avoid surprise charges.

Easily put a stop to subscriptions with a click of a button.

Whether it be a category-based 1x, 2x, 3x reward multiplier or earned based on specific actions, you’re in control to customize an engaging experience for your audience.

Hierarchical LedgerUntapped potential

Mix and match lending balances and interest models with parent/child relationships between multiple loan products

A revolving credit line that works in harmony with other products

Balance Transfer/Cash Advance

APR Based on Transactions

Family Sharing

Installment Lines

Multi-Tenant SaaSA scalable platform

Our nimble, multi-tenant, cloud-native architecture allows you to edit quickly and go live instantly

Cost-effective

High quality and fast innovation at a low cost

Nimble

Relies on configuration rather than manual operations

Instant

Self service, edit quickly and go live with a push of a button

Open APIs & SDKsEmbed and innovate

Flexible and secure, our API-driven platform seamlessly integrates into our partner’s ecosystem

Built for scale, our developer-friendly Open APIs provide you with tools to build an innovative program

APIs

APIs for Underwriting, KYC/KYB, Servicing, Card processing, and Program and Product setup

SDKs

We provide SDKs to eliminate PCI risk and add features like Push Provisioning, Display PAN, etc.

Private Sandbox

Build and test apps with Sandbox access

Simulators

Simulators for credit card transactions, payments, statements, delinquencies, and credit life-cycle